reg-x – Emir Trade Reporting

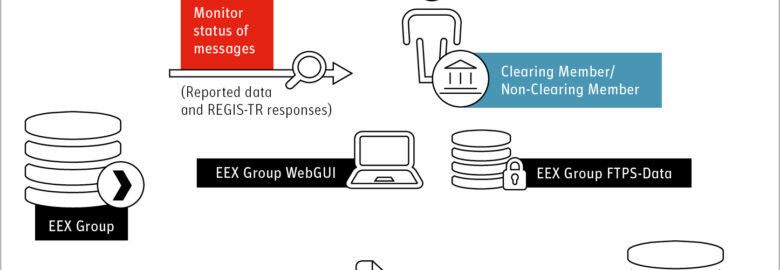

EMIR trade reporting is the mandatory requirement for parties in the EU involved in derivative transactions to report transaction details to authorized trade repositories. Reported data includes parties’ details, derivative type, notional amount, trade date, and more. The goal is to monitor activity, mitigate systemic risk, detect market abuse, assess counterparty risk, and boost investor confidence in the EU’s derivatives market.